Investing with SAFEs: How to support reproductive justice & equity

This is a continuation of the discussion “Why would we use private equity to advance reproductive justice?”

Before we get started - out of curiosity, would love to know where you are coming from

Comma, Mae, & Choix: Three leaders innovating to advace Reproductive Freedom

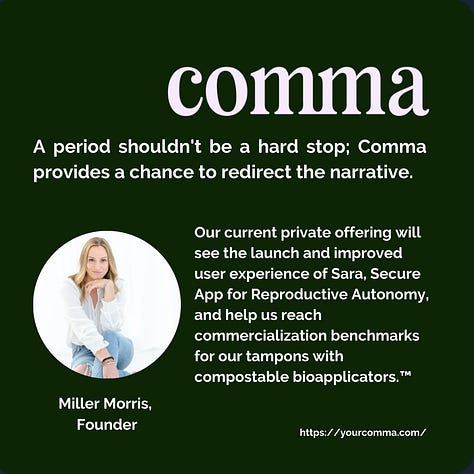

Miller Morris, the Founder & CEO of The Comma Collective, introduced her work: In order to address the growing need for reproductive healthcare, Comma has developed the first and only HIPAA-protected period tracking technology, known as Sara, as well as the first biodegradable tampon. This private offering will help to launch and improve the user experience of Sara, as well as reach commercialization benchmarks for the tampons. Comma has chosen to pursue a SAFE (Simple Agreement for Future Equity) crowd-equity raise due to its many benefits. This includes its "lingua franca" which helps to provide a comfortable environment for both founders and funders, as well as its lack of maturity date. As a social enterprise, Comma has also found SAFEs to be a simple and straight-forward way to include terms regarding revenue sharing.

Cindy Adam, FNP Founder of Choix shared “Choix is a telemedicine clinic providing compassionate abortion & reproductive and sexual healthcare We exist to meet patients where they are and bring them the accessible, supportive, and non-judgmental sexual and reproductive care they need so that individuals, families and communities can lead the lives they want to lead.”

By choosing to pursue a SAFE crowd-equity raise, Choix was able to open up its crowd-equity offering to a much wider pool of investors. This included individuals who may not have had access to traditional venture capital, or who may not have been accredited investors. It also allowed Choix to reach individuals who shared their values, and who wanted to join in the mission of expanding access to safe and legal reproductive services.

Maya Hardigan, the Founder of Mae, shares “Mae’s model not only prioritizes digital-only solutions, but also seeks to address the bias in care that Black women face. By incentivizing healthcare payers, investing in evidence-based interventions, and increasing access to these interventions, Mae is working to improve pregnancy experiences and outcomes and reduce the costs associated with poor outcomes.”

Mae has chosen to pursue an innovative approach to address the disparities faced by Black women. By combining weekly health tracking, real-time issue escalation support, culturally resonant resources and education, and on-the-ground support from community-based birth workers, Mae is working to reduce maternal health disparities for Black women.

Learnings from the Fundraising Process

The biggest unexpected win from the fundraising process has been the community it has created, shared Miller. Founders have been generous in connecting others with like-minded people, and investors have been generous with their expertise and networks. However, there have been some drawbacks, particularly when dealing with older investors or those who do not often invest in tech.

It is also important to consider the role of impact investing when it comes to SAFE investing. Impact investing is a form of investing that focuses on driving social and environmental change in addition to financial returns. This form of investing has become increasingly popular in the reproductive healthcare industry, which is why Choix chose to pursue a SAFE crowd-equity raise. Impact investing allows investors to support the mission of a company and help to drive positive change in the reproductive justice sector.

As Cindy shared, “As a wave of abortion restrictions and bans take hold across the country, the goal of the public equity campaign was to meet the urgency of the moment and allow Choix to advance its vision of a sustainable infrastructure for accessible abortion care nationwide.”

The Limits of SAFEs

While there were some drawbacks to the crowdfunding process, such as limitations in how Choix could message and market, the campaign allowed Choix to create a community of supporters around their mission. It also helped to raise awareness about their planned Choix Benefits offering, which will help to create a sustainable infrastructure for reproductive services.

As Cindy points out, “Venture is inherently very risky, so why is abortion care that much more of a risk? If you truly support access then we urge you to consider the risk in NOT investing in this crucial care and to instead see the great opportunity in supporting access during this critical moment in time.”

While a SAFE can be effective for raising under $1M, as a venture scales the crowd-equity approach starts to hit its limit.

Mae raised an initial $1.3M round from SteelSky Ventures and Maria Velissaris, Founding Partner at SteelSky, shared in an interview with Business Wire that “Black maternal healthcare is a national crisis. While structural and systemic bias continue to plague our healthcare system, solutions like Mae are vital to empower women to access, educate and advocate their way to better outcomes.” Maya is continuing to grow Mae, with a priced round Seed stage raise underway. "While we were excited to explore the use of a SAFE in our previous note raise, we found that not all of the investors we were targeting had an openness to that instrument."

The challenge in reaching enough people to be able to close a larger fundraising effort requires a level of marketing, network outreach, and access to higher net worth networks that can be out of reach for many founders - especially working in sexual & reproductive health & justice. Many people are still unfamiliar with SAFE investments, and it can be challenging to both raise a round and educate your investors about a new financial instrument. Also as Maya shared, not all experienced investors are comfortable with an instrument that can create obligations for future rounds.

The Time for Innovation is Here

Miller shared, “There is a risk tolerance in the corporate world that begets innovation, and does so at a much faster pace than is possible in the public sector. If you want to see meaningful change for reproductive justice in your lifetime, you can't just donate. You have to invest.”

For founders looking to pursue a SAFE crowd-equity raise, they should remember that the most important asset they bring to the table is their passion and purpose. Impact investors should also remember that reproductive healthcare companies need more than donations, they need capital to innovate and make meaningful changes in the reproductive justice sector.

The goal is to use both private equity and traditional philanthropy to support abortion access, Black maternal health outcomes, and data privacy for people with periods. By tapping into every asset class, we can move the scale of capital needed for lasting and systemic change to protect bodily autonomy and ensure safe and secure reproductive healthcare for all.

To learn more about SAFE’s check out this great presentation from Kristy Nathoo for Y Combinator.

Gratitude to Dil Bola from Spring who helped to draft this article. We also played a bit with ChatGPT and NotionAI to help with copyediting.